RBI has been working on the Digital Rupee for a long time now. Its first trials kicked off on November 1. In a recent development, the financial body is all set to run another pilot test for the same. These tests for the India’s official digital currency will start from December 1. The first pilot test focused on the wholesale segment. This time, it will focus on the retail segment of the Indian market. The trials will be conducted in shortlisted locations in closed user groups (CUG) consisting of customers and merchants.

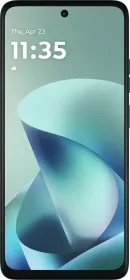

As for the Digital Rupee, it will be used as a digital token that will represent legal tender. The e-Rupee will be distributed in India via intermediaries like banks. All the selected users will be allowed to carry out transactions with the e-Rupee. The participating banks will provide a digital wallet for the transactions. Users can pay the merchants with the help of QR codes, which is quite similar to what we do right now with the money in our bank.

Another major highlight of the Digital Rupee is that it can be converted into different forms like bank deposits. One thing to note here is that no interest will be generated on the Digital Rupee. In the first phase, eight banks are going to participate in the distribution and holding of the Digital Rupee – Bank of Baroda, Yes Bank, Union Bank of India, IDFC First Bank, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, State Bank of India.

Use case of Digital Rupee

The government will use the Digital Rupee or the Central Bank Digital Currency (CBDC) as a digital token representing legal tender. It is being said that e-Rupee is going to make interbank market transactions highly efficient. Readers should not confuse it with any kind of replacement for physical cash or a reply from India for cryptocurrency. It is simply an additional alternative to the forms of money that are currently available in the country.

In comparison to the Unified Payments Interface (UPI), the Digital Rupee will be directly operated by the Reserve Bank of India (RBI), unlike the former. For your information, UPI is managed by bank intermediaries in collaboration with RBI. A notable difference between the two is that every rupee transferred by UPI is equivalent to the physical currency. The case is quite different in terms of Digital Rupee, as it will not necessarily be equivalent to the physical currency. It can be seperately used as legal tender.